The VDMA Robotics + Automation Association (VDMA R + A) expresses concerns about the German robotic industry. The German Business Association, which falls under the umbrella of VDMA, which has 420 membership companies, said the robotic and automation industry of the country “lost competitiveness.

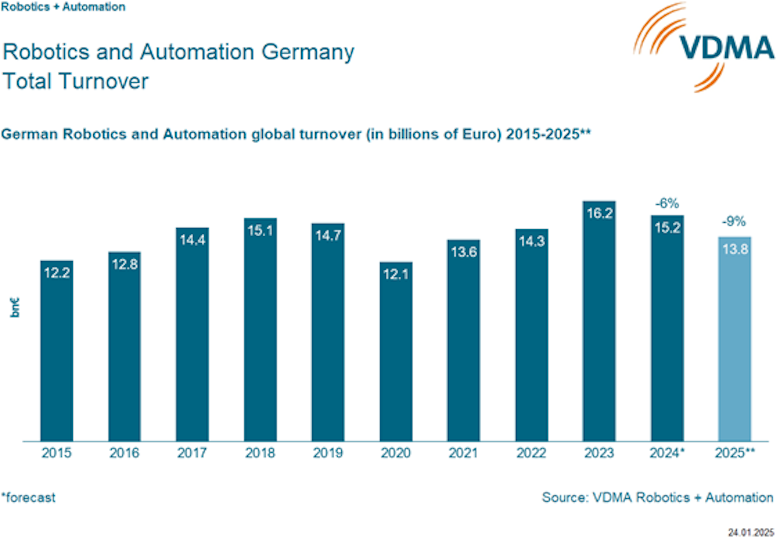

The VDMA R+A prognosis that the German robotic and automation industry will drop to 13.8 billion euros ($ 14.4 billion) in the total turnover in 2025. “Total turnover” is the term Germany to describe the money that the country’s businesses earn from sale for a certain period of time. According to the association, the sector closed with a 6% decrease in turnover in 2024 for 15.2 billion euros ($ 15.8 billion).

Dietmar Ley, who was appointed chairman of VDMA R+A in November 2024, quoted several reasons for the decline.

“The trend of sales in the robotics and automation industry requires action,” he said. “The current declining trend is not only based on cyclic fluctuations in demand has been very tangible structural causes. These include, for example, excessive dependence of robotics and automation in the German automotive industry. In addition, there are weaknesses in competitiveness with which business and policy have to deal with reforms. ”

VDMA R+and said these structural weaknesses that we belonged to in 2024.

Growth stimuli from abroad were also stimulated, showing a decline of 2%. The only clear place for the German robotics industry and automation was exports to the euro area, with incoming orders in 2024 rising by an impressive 44%, said VDMA. The euro area is a currency union 20 Member States of the European Union that has accepted the euro as its primary currency.

On the other hand, the organization based in Frankfurt, Germany, said that foreign demand with the exception of euro area countries was 13% below the previous year.

“Companies in the German industry robotics and automation must focus on their own competitive,” Ley said. “The priority is to speed up innovation. There is also more dexterity to respond quickly to customer demand and divide from competitors abroad. Finlly, we also have to reduce the cost of the competition.

In June 2024 VDMA warned that growing competition from China had weight on its own robotic ecosystem. “Many Chinese suppliers have grown strongly on their home markets and are now pushing into Europe,” the group said at that time.

Sign up today and save 40% We Conference Pass!

VDMA chairman requires reforms

Ley also demanded a determined reform agenda from politicians.

“With the aim of harsh global competition, Germany cannot afford disadvantages such as disproportionating regulation and excessive costs,” On Green. “The economy needs reliable framework conditions in Germany that support, not hindering growth. Only then robotics and automation are doing again. ”

“All long -term growth trends for our innovative industry remain intact. Now we have to set the right race, ”Ley stressed.

Germany is not alone in slowing robotics

A3 said the sale of industrial robots was in North America in 2024. Credit: Steve Crowe

Germany is not the only country to see that its leading robotic industry sees slowing. China, a large industrial robotics market in the world for 10 years, expected its industrial robot sale to fall for the first time in five years in 2024.

According to the Shenzhen Gaogong Industrial Institute (GGII), the total supply of industrial robots (GGII) achieved the total industrial robots in the country (GGII) by 5% of 2023. Ggii said that the decline was “apparently tightening demand” from the automotive and renewable energy sectors.

After a record back-to-back flight in 2021 and 2022 during the height of the Covi-19 pandemy, the sale of industrial robots in North America in 2023 recorded a new decline and essentially flat growth in 2024, according to the Association for Automation (A3 (A3 ( A3).

Jeff Burnstein, President A3, recently wrote an open letter to the elected President Donald Trump, saying that automation is the key to turning US production Burnstein recommended that the federal government cooperate with the robotic industry economically and economically and for National and National Security. This message has been reused several times on the A3 forum.

It will be the interests to read the report of the International Robotics Federation (IFR) “World Robotics” when it is available this year. The annual report immerses in the number of industrial robots operating in the factory around the world.

For 2023, IFR said that there were 4.281.585 robots that operated in Asia in Asia, 17% robots in Europe and 10, which was in Europe and 10 10% increase from 2022. According to the region, 70% of all new robots were In Asia, 17 % in Europe and 10 % in Europe America.

Credit: IFR “World Robotics Report 2024”